The ATO produces a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees. A tax withheld calculator that calculates the correct amount of tax to withhold is also available.

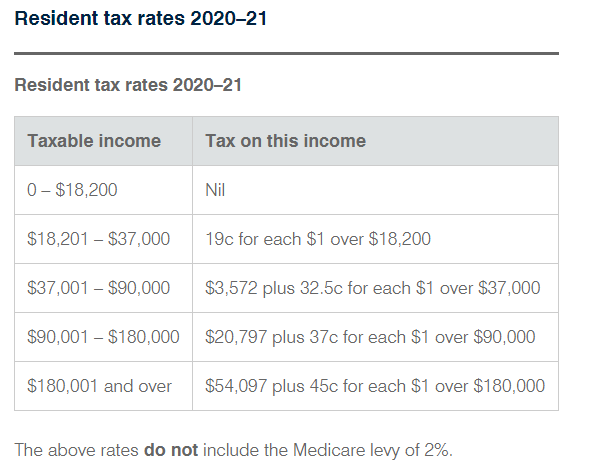

There are currently no changes to the tax rates or income thresholds for the 2020–21 income year. Changes announced in 2019 to the low and middle income tax offsets were only in respect of the amount of that offset. This is claimable when individuals lodge their tax return.

In 2019, the HELP, SSL and TSL tax tables were renamed ‘Study and training support loans tax tables’. They incorporate HELP, VSL, SFSS, SSL, ABSTUDY SSL and TSL. There are no longer separate SFSS tax tables.

To view further information, to access the ATO tax withheld calculator or tax tables, click here